sim update December 2019

SIM HAS JOINED EUROPEAN CHAMBER!

Source: europeanchamber.com

Being the independent voice of European business in China, the European Chamber presents on behalf of its members to relevant Chinese government and agencies their key concerns and recommendation regarding regulatory environment in China. The goal of the Chamber is always to try to improve the business environment for our members by strengthening their ties with local leaders and bringing about changes in strategically important regions and in China in general that truly benefit their members.

Jointly with European business associations and member companies, the European Chamber has built a remarkable platform in areas including medical devices (COCIR and CDMD), wood material (European Wood), cosmetics, foods (cheese, FSMP and Pediatric Nutrition), fashion and leather, and automotive (Independent Aftermarket). These platforms have become major stakeholders within EU-China trade relations and are viewed as dependable partners for the Chinese authorities when seeking input for further regulatory development. Furthermore, the European Chamber is also a consortium partner for projects funded by the European Union such as the China IPR SME Helpdesk, the EU SME Centre, and GNSS Asia.

Working groups

At European Chamber, A Working Group (WG) is composed of at least six corporate members with a mutual interest in a minimum of three lobbying issues and the capacity to represent their industry and issues. A WG produces an annual Position Paper with recommendations and engages in lobbying activities. “Lobbying” refers to attempting to influence Chinese policy makers either through direct communication or indirectly via other channels (e.g. EU institutions, the media, etc.). Involvement may be limited to member companies that have a direct interest in the industry that the Group serves.

Beside the working group, other meeting types like forum, desk and task force are also held from time to time.

A Forum provides a platform for networking and knowledge-sharing through meetings, events and other forms of communication. It is composed of at least six corporate members and is typically open to all members. However, involvement may be limited to member companies that have a direct interest in the industry the Forum covers. The Forum will have a shorter Position Paper than the WGs, in which they provide a brief overview of their activities in 200-300 words.

A Desk is formed, when an external organization or association or a group of member companies desire additional representation by the European Chamber. The scope and activities of the Desk depend on the needs of the parties involved.

A Task Force is a loosely constructed group comprising a number of industry experts focusing on a certain topic which is of concern to European Chamber members but does not require consistent efforts like Working Groups and Fora. When required, the experts in the group will be called upon to provide their opinions on given topics. A task force does not have a position paper, a business manager or a lobbying agenda.

By actively participating and getting influenced from the development of increased market opening and regulatory reform in China, any member of the Chamber can:

- Join forces with other companies in policies

- Participate in working-level and technical lobby meetings

- Receive the latest policy updates and industry-specific information

- Gain access to government contacts

- Exchange insights regularly at Working Group meetings

- Leverage high-level networking opportunities for business development

We at sim are grateful and proud to be now a member of the European Chamber, together with other companies and institutes, to contribute to the development and strengthen the business relationship between Europe and China!

During the preparation phase, our team coordinated with Shanghai Swiss Consulate General for setting up the roundtable. After determining the schedule and venue, we successfully invited Shanghai airport group and the City of Basel as the supporting parties of this event, and had Mr. Gian Alessi, Executive VP Cargo of EuroAirport, Mr. Yu Zhou , General Manager Cargo of Shanghai Airport Authority and Mr. Thomas Kuhn from Fracht Shanghai as speakers of the workshop. Meanwhile, our team took care of the arrangements of the translation, transportation, and the distribution of branding related articles, ensure the accuracy of all details while gaining high efficiency.

The event setting allowed the speakers to present their cases in a very close and professional environment. Airports, Authorities and Freighters exchanged their business approach, their needs and challenges, but also their hopes for future development of the industry around one table.

Through this kind of round table setting, European airports have established a close communication with representatives of the aviation logistics industry, such as airports, airline companies, freight forwarders, etc., to achieve a deeper understanding of their needs as well as to establish more potential leads for future cooperation and development.

At the end of the roundtable event, Mr. Gian Carlo Alessi thanked all the speakers and expressed that more similar workshops will be held in order to build up a bridge of communication in the pursuit of mutually beneficial and win-win development between airport/airline agencies of China and the EU.

EuroAirport is the only Airport serving three countries at the same time! Located at the heart of Western Europe and at the crossroads of three economically thriving regions (Alsace, North West Switzerland and Baden-Württemberg), its extreme convenience explains the airport’s success. EuroAirport is the best equipped airport on the Upper Rhine and, thanks to its infrastructure, can cope with any kind of traffic. It held up to a total number of 8.6 million passengers in 2018. The scheduled flight network includes around 100 airports in more than 30 different countries. Normally they can be reached directly every day or at least several times a week without changing.

At EuroAirport, more than 25 different airlines handle approximately 100-120 daily scheduled flights. The market leaders are easyJet and Wizz Air, followed by Lufthansa, TUIfly, Air France and British Airways. The presence of the leading international airline alliances Star Alliance, SkyTeam and oneworld, which offer connections to their hubs in London, Paris, Frankfurt, Munich, Düsseldorf, Amsterdam, Brussels, Madrid, Istanbul, Barcelona and Vienna several times a day, providing the customer with full access to all the European intercontinental hubs.

EuroAirport is not just a gateway to the world, but also to the tri-national region for all those who visit. In 2016, approx. 1 million passengers were incoming tourists. This potential can be further developed by means of specific regional tourism promotion.

In the business of aircraft maintenance and outfitting, EuroAirport, with the local firms Jet Aviation, AMAC Aerospace, Air Service Basel and Nomad Aviation, is also one of the world’s leading competence centers for better-class business and private aviation.

The range of services offered by EuroAirport will continue to develop. In the passenger sector, there are prospects of extending the Eastern European connections, of optimizing the range of classical business destinations and holiday flights, as well as of diversifying the choice of flights through attracting additional airlines.

Source: www.euroairport.com

Services provided by sim

We at sim are the official representatives of EuroAirport in China.

Our aim is to build and maintain an industry network, to liaise and re-connect with local airport authorities and other stakeholders and to work towards and assist in establishing a direct connection between China and Basel!

With those goals in mind, we analyze and build market knowledge of the aviation industry in China and promote EuroAirport among all important authorities and organizations. To foster our network in the Chinese aviation industry, we attend industry events all over China and build and maintain relevant government relations in the industry.

We constantly search for new business opportunities for EuroAirport and assist to organize events and trips for EuroAirport delegates in China and accompany them on their business trips & meetings.

For more inquires, please visit EuroAirports official site or contact Isabelle Zhang for operation in China.

NEW RETAIL IN CHINA: LOOK INTO THE FUTURE OF ONLINE BUSINESS

How new retail comes into view

According to a report released by whom?? at the China International Big Data Industry Expo 2019 in Guiyang on China’s e-commerce development in 2018, over 9 trillion yuan of retail sales were made online with a total online purchase amount that exceeded 200 trillion yuan last year[1].

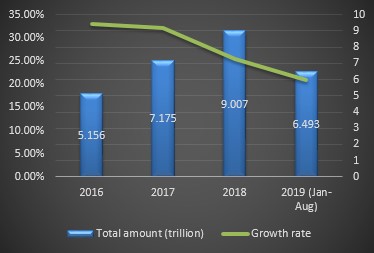

Figure 1: 2016-2019 Total online retail sales amount in China (The data of 2019 is from January to August)

Data source: National Bureau of Statistics

Behind lies the fact that the growth rate is slowing its pace, as some shortcomings of online sales compared to the offline world have been more and more exposed along with its development: The shopping experience is always inferior to offline shopping considering the visibility, audibility, ability to be touched (which is extremely important in China), sensibility, usability and other intuitive attributes that offline physical stores have. Other than that, online e-commerce players have never found a realistic path which can provide real scenes and good shopping experience.

Another aspect, failure to meet consumers’ growing demand for high-quality, heterogeneous and experiential consumption will become a “hard wound” that hinders the sustainable development of traditional online e-commerce enterprises. With the continuous increase of the per capita disposable income of Chinese residents, people no longer only focus on the advantages that online e-commerce used to be proud of, such as low price, but pay more attention to the experience and feeling of the consumption process.

Therefore, the exploration and application of “new retail” mode to initiate the upgrading of consumption shopping experience, promote the transformation of consumption shopping mode, and construct the omni-channel ecological pattern of retail industry will surely become another beneficial attempt for traditional e-commerce enterprises to realize self-innovation and development. “In the next 10 or 20 years, there will be no e-commerce, only new retail.” said Mayun, founder, former chairman of Alibaba during the Ali Yunqi conference in October 2016.

[1] http://www.chinadaily.com.cn/a/201905/28/WS5cecfadaa3104842260be4b1.html

Elements of new retail

By mentioning ‘New retail’, the basic idea is not a brand new way/method of retail operation, but a form of remodeling the old retail business and concentrate on improving the experience of consumers, to generate more valid online orders than offline, and to strengthen the connection between the retailer and the customer. At this stage, the new retail model is consisted of three parts: Consumer recognition, goods and distribution and sales venue.

- Consumer recognition

One common knowing is that consumers of different aging groups have different shopping habits and reactions. In China, the saying goes, as the 70s’ tend to make the purchase only when the old ones are out-of-use; the 80s’ tend to purchase as soon as they have the need; the 90s’ will make the purchase whenever a product wins their affection, and the 00s’ will just buy things whenever they feel the need of making purchases.

In the old times, the retailers can only recognize their customer’s behavior by going over the sales data, but with the technical support of intellectual managing and big data, the information of the customer can be synchronized and shared both online and offline, thus combine the offline experience of goods and online shopping, enable retailers to provide more choices and recommendations for their customers.

- Goods and distribution

With the sense of customer shopping experience being more and more important and demanding for retailers, the goods are no longer just products, but a certain system of supply chain, which includes the diversity, individuation, filled with content and customizing of the product, and further speaking, a solution, a sense of belonging, care and emotional offering of the retailer itself.

Here we can get a glance of the operation mode of freshhema: Consumers can make the purchase either at offline stores or place an order in App. One of the biggest characteristics of freshhema is fast delivery, which can be made within 3 kilometers of the store, and takes within 30 minutes for its delivery to the door. The biggest difference between freshhema and traditional retail is that it uses big data, mobile interconnection, intelligent IOT, automation and other technologies and advanced equipment to achieve the optimal matching among consumers, goods and sites. From supply chain, warehousing to distribution, freshhema has its own complete logistics system, which can ensure the freshness of goods originated from the source and optimize user experience.

Picture source: dianping.com

- Sales venue

Old retail models have limited the process in certain entity scenes like stores and supermarkets, with the development of e-commerce, the process has been moved online. New retail modes enable customers to experience in a combined way of both offline and online, and can directly experience operations by AR or VR interaction games/videos. And with the help of newly developed apps like the Little Red Book (xiaohongshu), consumers can share some experience in the using process of the purchased products, while other consumers can get information through their sharing. In fact, they complete the interaction between users and products in a kind of social interaction and sharing, thus causing new flow of customers and to generate sales.

Policy support

On November 11, 2016, the General Office of the State Council issued Opinions on Promoting the Innovation Transition of Entity Retail (No. 78 issued by the State Office), which clearly defined the guiding ideology and basic principles for promoting the innovation transformation of Entity Retail in China. At the same time, specific deployments are made in adjusting the business structure, innovating the development mode, promoting cross-border integration, optimizing the development environment and strengthening policy support. The “Opinions” emphasizes on the promotion of online and offline convergence: “Establish standards and competition rules to adapt to the development of convergence, guide entity retail enterprises to gradually improve the level of information technology, integrate the advantages of offline logistics, services and experience with online business flow, capital flow and information flow, and expand the overall channel layout of intellectualization and networking. ”

Expectable future: replacing e-commerce

With the gradual landing of the “new retail” model, online and offline will gradually transform from relatively independent and conflicting to mutual promotion and integration, and the manifestation and business path of e-commerce will inevitably undergo a fundamental change. When all retail stores have obvious “e-commerce” genetic characteristics, the traditional “e-commerce” will no longer exist, and the serious impact of e-commerce on the real economy, which people often complain about in current days, will become history.

Stay tuned, next time we will share with you insights on “New Chinese cross-border business regulations”.

According to CNBC, the total e-commerce sales amount of T-mall from Alibaba hit over $30.8 billion in this 24-hour shopping event in 2018, $5.5 billion higher compared to the previous year. The amount was reported to exceed $1 billion in the first 1min25secs of the day (however mainly caused by the way by the payment of tailing amounts of the pre-sales.).

Employees cheer in front of a screen showing Alibaba’s sales volume exceeding 213.5 billion yuan (about 30.7 billion US dollars) during the Alibaba Group’s 11.11 Global Shopping Festival on November 12, 2018 in Shanghai, China.

VCG | Getty Images

JD.com (JingDong, JD), is China’s second e-commerce behemoth, whose sales for Singles’ Day of 2018 – and its run-up events – reached 127.1 billion yuan ($19.14 billion), a 50 percent raise compared to the previous year. The total sales however included 11 days of transactions, JD said in a statement, unlike its rival Alibaba, JD started its sales event on Nov. 1, to reduce delivery bottlenecks and to give users more time to make their purchasing decisions. Of all consumer goods, fresh foods and cosmetics were some of the online retailer’s biggest movers, with JD selling over 500,000 Thailand black tiger shrimp and about 55 million facial masks over the period.

Countdown to the main double 11 event has begun in the early morning of October 21st. Everybody held their breath and started browsing their mobile phones, trying to fetch every lucky envelope and coupons available. This year, Tmall has offered red envelopes of value up to 2 billion yuan. Really a big deal indeed! In contrary, the 100 million offered by JingDong seems not worthy to be mentioned, would there not have been the outburst of a serious sales system bug on a self-owned store of the JD platform which has attracted mass attention.

On 28th October, JD started to offer coupons, with which consumers can get a 100 yuan discount when their order of goods within one store exceeds 199 yuan. Funny thing is, at 12:00 midnight on the same day, stores like UNILEVER and L’OREAL released exclusive in-store discount pages, on which you can get the same amount of discount as the coupon when buying shampoos. So, if the consumer combined the two discount methods above, they would be able to get 10 L’OREAL shampoos with their original price marked 19.9 each simply for free, and that was exactly what happened on that inconceivable night of sheep-shearing.

It took the JD technicians only 5 minutes to detect the bug and fix it, but more than 10,000 of these ‘bug’ orders have been placed by that moment. According to the regulations, the self-owned stores have to go through the normal process and deliver the goods to the customers despite of the fact that they will not be able to retrieve even one cent from them.

While mocking this occurrence, it triggered also the discussion, of whether it wasjust an error as it seemed to be, or a weird but effective way of getting the target consumers attracted? Because as everybody talked about it, the marketing value of that “stunt” was considerable… Be it as it may, next Double 11 will come soon enough!

For more intriguing contents, please go to our website and check our latest publications at https://sim.biz/news-publications!